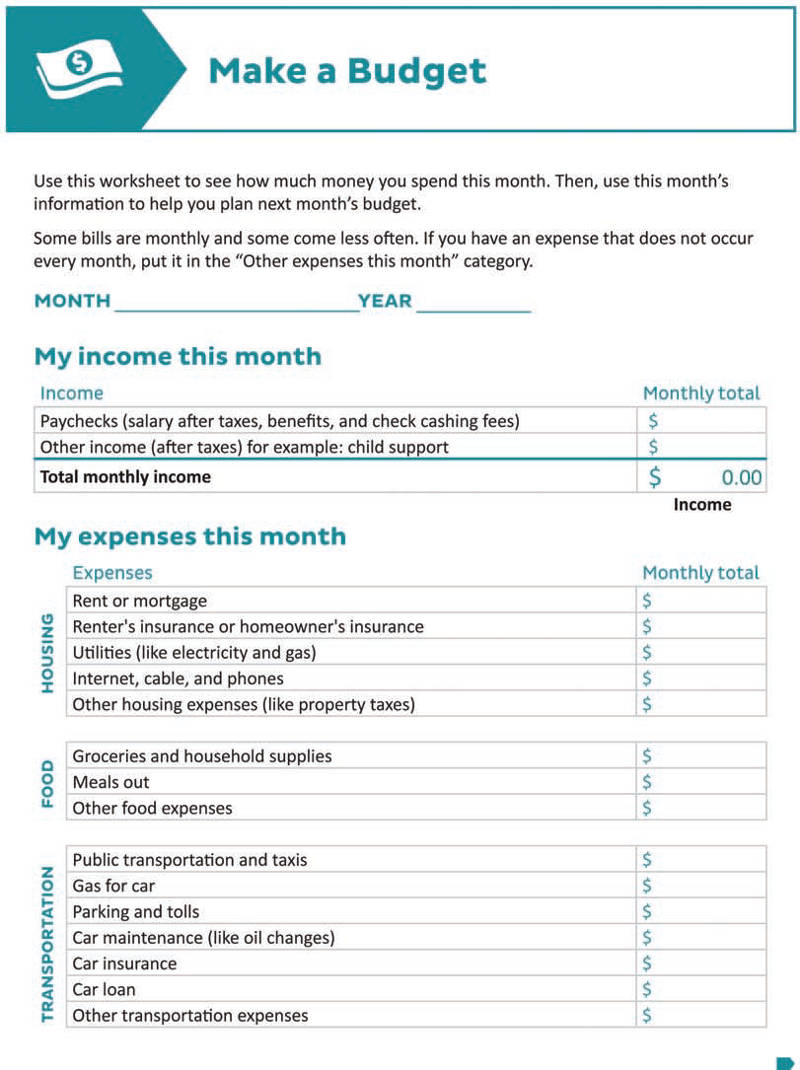

You can download a copy, which can be printed and filled out by hand, or you can download a fillable PDF version, which can be filled out and saved on your computer. The steps you are going through can also be viewed as a PDF workbook. Attend a free, online budgeting workshop and have someone show you what you need to know.Budget Calculator Spreadsheet that guides you as you build your budget and looks for ways to improve it.7 Steps to a Budget Made Easy - A brief overview of this 7 step budgeting process.If all this looks like too much work, or you're really looking for something much quicker right now, check these out: Once complete, your budget is the solid foundation with which you can manage your current income and expenses and plan for future possibilities. It is based on choices you make and priorities that you identify.īuilding a spending plan, or budget, is a step–by–step process.

However, for many people, the word "budget" evokes feelings of fear or frustration. The foundation of sound money management is the budget. Ask yourself how much effort do you put in managing your own money? Do you keep track of what you spent in a day, week, or month? How many times do you regret spending so much money on something that will benefit you so little? You do not need to share your answers with anyone – they are merely to help you identify how you may want to improve your own money management skills. Answer the following questions truthfully, based on what you do today. It simply means getting the most from the money you do have.īefore you read any further, take a quick look at your current money management skill level. Here are some simple steps to create and maintain a household budget. By having a household budget in place, you can easily track your spending, save, and more easily monitor and reach your financial goals. Proper money management does not involve a magic formula to find more money. Creating a budget helps you understand where your money is going each month and also allows you to develop a plan for saving. It’s not how much you make, but what you do with what you've got. The first step toward planning your budget is to determine exactly how much money you have.

Someone who manages their finances responsibly has peace of mind and knows how to: People might not earn more money if they budget well, but they will be able to use the money they do have wisely. Like driving a car or playing an instrument, the skill of managing money must be learned – and it’s never too late to start! Doing so usually pays immediate benefits.

#CREATING A HOUSEHOLD BUDGET HOW TO#

Therefore, many people experience the usual emotions that occur when they don’t know how to do something well. By the time we’re adults, we are expected to be able to manage our money effectively however few of us are taught how. No one is born with money management skills. Did it come with instructions? Instructions seem to be included with the simplest devices these days, and yet, with something as important as our pay cheques, we’re left to figure it out on our own. Think back to your very first pay cheque – paper route money, babysitting income or a cheque from a part–time job. 7 Steps to Build a Household Budget | Money Management Strategies

0 kommentar(er)

0 kommentar(er)